Get Free Consultation

Market Overview:

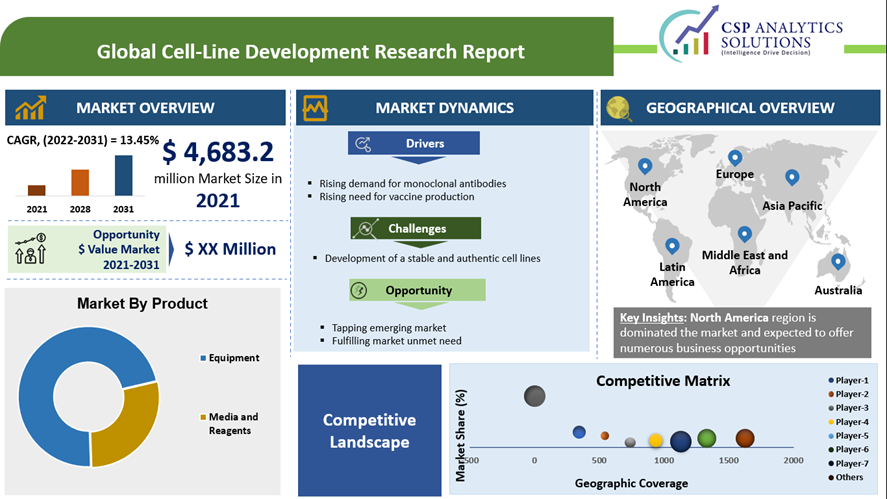

Global Cell Line Development Market is expected to offer an $ opportunity of USD 10,149.30 million over the forecast period.

Global Cell Line Development Market size is expected to surpass USD 14,832.5 million by the end of 2031, growing at a CAGR of 13.45% over the forecast period, i.e., 2022 – 2031. In the year 2021, the industry size of Cell Line Development was USD 4,683.2 Million.

| Base Year | 2021 |

| Forecast Year | 2022-2031 |

| CAGR | 13.45% |

| Base Year Market Size (2021) | USD 4,683.2 Million |

| Forecast Year Market Size (2031) | USD 14,832.5 Million |

Throughout the long term, the biopharmaceutical market has developed into a promising, high worth vertical inside the general drug industry. Truth be told, almost 29% and 25% of the complete number of novel medications endorsed by the Food and Medication Organization's Middle for Medication Assessment and Exploration (CDER) in 2018 and 2019, separately, were biologics.

Subsequently, the pipeline of biologics and biosimilars is developing at an estimable speed. Considering that the turn of events and assembling of such treatments require living natural frameworks, there has been a flood popular for various sorts of cell lines. As a matter of fact, around 84% of the remedial proteins showcased over the most recent five years, were created utilizing different mammalian and microbial cells.

Given the cost intensive nature of pharmacological R&D, medical researchers / drug developers are consistently on the lookout for ways to optimize operational efficiencies, as well as reduce affiliated costs; in this context, outsourcing has emerged as a preferred business model. Presently, there are several contact service providers that claim to have the necessary expertise to develop and characterize cell lines. The technical aspect of this field is also witnessing a lot of innovation, especially with regard to automating various steps of the cell line development process.

New genome editing technologies, such as the CRISPR/Cas-9, are also being extensively used to improve the quality of recombinant cell lines. Unlike drug developers, the capabilities of service providers are usually more focused to their respective service portfolios.

Moreover, such companies ensure that they have the latest upgrades in equipment and infrastructure, in order to improve the quality of services offered. In fact, in the recent past, a number of service providers offering cell lines-related services, have forged strategic alliances with and / or acquired other players, in order to further enhance their respective portfolios. Considering the growing trend of outsourcing and the ongoing efforts of service providers to improve / expand their offerings, we believe the contract services market for cell line development and characterization is likely to evolve at a steady pace, till 2030.

Market Dynamics: The growth primarily attributed to the factors such as:

Growth Enablers:

Challenges Associated with the CLD Market:

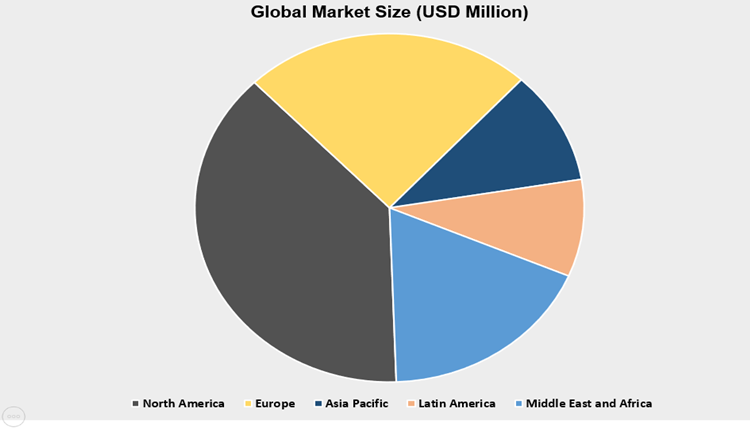

Regional Market Outlook:

Currently, North America is accounted for the largest share in the global market, owning to higher demand for novel and targeted medicine accompanied with growing R&D activities in the region. NA id accounted for almost 36.75% of total global market share followed by Europe. Asia-Pacific is growing at a 15.76% CAGR during the projected timeframe. At institution-level, research activities are at higher end.

Addressing Challenges: Contract development and manufacturing organisations (CDMOs) can shorten commercial timelines and increase programme efficiencies without sacrificing product quality or yield, by understanding and using best practices.

Our report has covered several other key aspects pertaining to market:

Strategic Developments in the Market:

Competitive Landscape:

Market Segmentation:

Our in-depth analysis of the Global Cell Line Development Market includes the following segments:

| Global Cell Line Development Market | |||

| Base Year: | 2021 | Forecast Period: | 2022-2031 |

| Historical Data: | 2021 | Market Size in 2021: | USD 4,683.2 Million |

| Forecast Period 2022-35 CAGR: | 13.45% | Market Size in 2031: | USD 14,832.50 Million |

| Segments Covered: | By Product |

| |

| By Industry |

| ||

| By Cell Type |

| ||

| By Application |

| ||

| By Region |

| ||

| Key Market Drivers: |

| ||

| Key Market Restraints: |

| ||

| Key Trends: |

| ||

| Companies Covered in the Report: |

Academic Profiles

| ||

Recent Developments in the Market: