Get Free Consultation

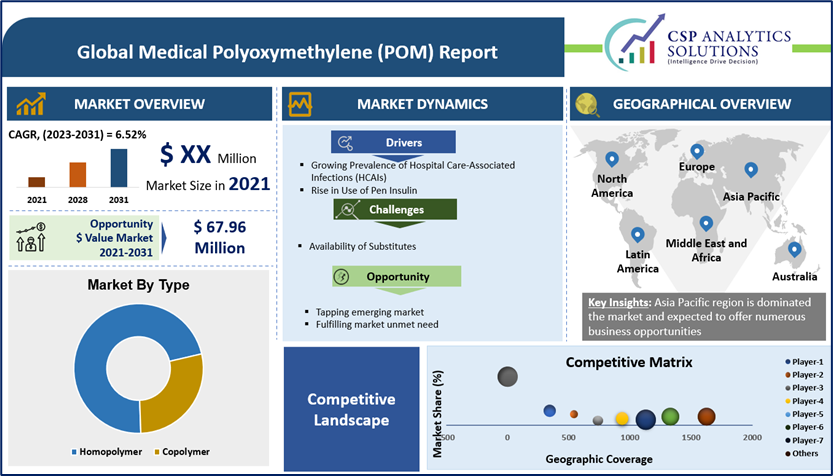

Global Medical Polyoxymethylene (POM) Market expected to offer $ opportunity of USD 67.96 million from 2021-2031 and expected to grow at a compound annual growth rate (CAGR) of 6.52% from 2021 to 2031, the size of the medical polyoxymethylene (POM) market is expected to reach USD 148.9 million by the end of 2031. Medical polyoxymethylene was a medical industry valued at USD XX million in 2021.

Global Market Size, Forecast, and Trend Over 2021-2031

| Base Year | 2021 |

| Forecast Year | 2021-2031 |

| CAGR | 6.52% |

| Base Year Market Size (2021) | USD XX Million |

| Forecast Year Market Size (2031) | USD 148.9 Million |

There has been a significant growth in medical industry over last few year. According to WHO, there as an estimated 578 million people expected be suffer from diabetes by 2030. This growth signalling the manufacturing of medical devices use for diabetes management.

There are number of CDMOs out there in the market using these raw materials for devices manufacturing. This growth in medical industry is further booming demand for healthcare and medical devices. Additionally, POM has a significant history in the medical industry, notably as an implantable substance.

The use of polyoxymethylene in tissue engineering is made possible by its properties, including excellent dimensional stability and thermal stability that enable steam sterilization. This is anticipated to influence the market potential for the expansion of the global medical polyoxymethylene market. Moreover, POM is an appropriate material for tissue culture since it significantly inhibited hematopoietic stem cells' ability to grow and form colonies, whether it was used as a growth substrate or as a medium-wetted component. Consequently, this is expected to create a huge opportunity for the market for medical polyoxymethylene to expand.

Growth Enablers

Challenges

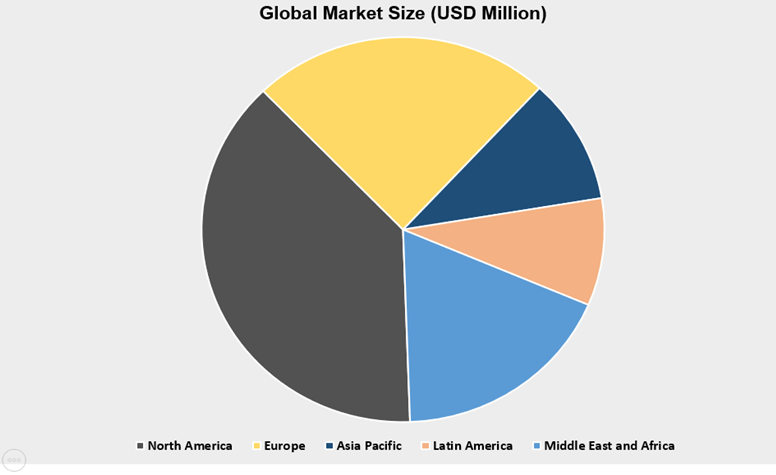

The Asia Pacific Region market amongst the market in all the other regions, is projected to hold the largest market revenue of USD 58.48 million by the end of forecast period i.e. 2031 and also growing at a highest CAGR of 7.93% over the forecast period. The growth of the market in this region can be attributed to various factors such as upsurge in industrialization, and expanding healthcare sector and significant growth in China marker expansion. Moreover, growing prevalence of diabetes and other chronic disorders is also estimated to boost the market growth in this region. For instance, India shares nearly 17.6% of global diabetes population, earning it the moniker "Diabetes Capital of the World.". This share is further projected to grow. In 2021 alone there were 101 million people suffering from diabetes. Diabetes care devices market was estimated around 31.3 billion in 2021, where majority of devices requiring Medical POM I their manufacturing.

ASTM F1855-00 (Reapproved 2019)

Standard Specification for Polyoxymethylene (Acetal) for Medical Applications

Scope/Abstract

1.1 This specification covers polyoxymethylene (acetal) resin for medical applications. This specification provides requirements and associated test methods for a form of this thermoplastic which is intended for use in manufacturing medical devices, instrumentation or components thereof.

1.2 As will any material, some characteristics may be altered by the processing techniques (such as molding, extrusion, machining, sterilization, and so forth) required for a specific application. Therefore properties of fabricated forms of this resin should be evaluated using appropriate test methods to assure safety and efficacy.

1.3 Although this resin has been used and for specific implant applications in the United States, the use of this resin in medical devices should be restricted to non-implant applications until biocompatibility evaluations appropriate for the intended applications are successfully completed.

1.4 The biocompatibility of plastic compounds made up of polyoxymethylene (acetal) resin containing colorants, fillers, processing aids, or other additives as well as polymer blends which contain polyacetal should not be assumed on the basis of resin biocompatibility alone. Their biocompatibility must be established by testing the final (end-use) compositions using evaluation methods appropriate for the intended applications. It should be noted that the types, test levels and biological effects of extractives yielded by the additives contained in a compound or blend may also have to be evaluated for some end-use applications.

Our in-depth analysis of the Global Medical Polyoxymethylene (POM) Market includes the following segments:

| Global Medical polyoxymethylene (POM) Market | |||

| Base Year: | 2021 | Forecast Period: | 2021-2031 |

| Historical Data: | 2021 | Market Size in 2021: | USD XX Million |

| Forecast Period 2024-35 CAGR: | 6.52% | Market Size in 2031: | USD 148.9 Million |

| Segments Covered: | By Type |

| |

| By Grade |

| ||

| By Application |

| ||

| By Region |

| ||

| Key Market Drivers: |

| ||

| Key Market Restraints: |

| ||

| Key Opportunities: |

| ||

| Companies Covered in the Report: |

| ||