Get Free Consultation

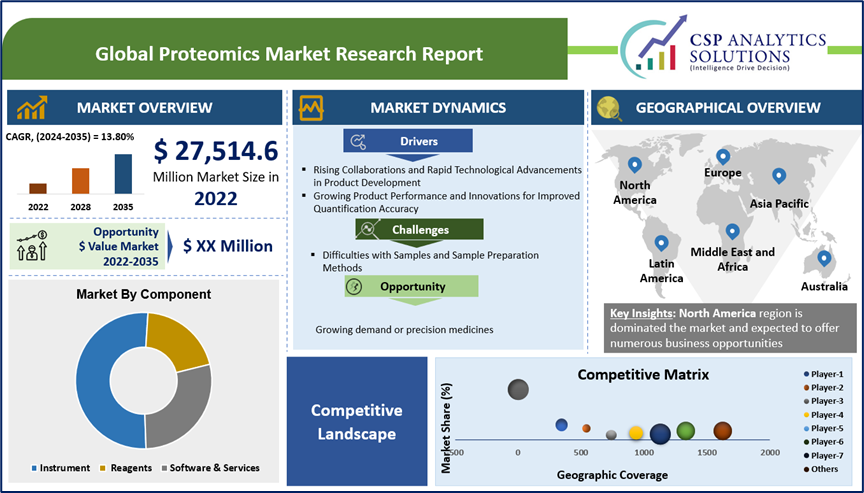

Global Proteomics Market is expected to offer an absolute $ opportunity of USD 117,350.9 million over the forecast period 2022-2035.

Proteomics Market size is estimated to reach USD 144,865.5 Million by the end of 2035, growing at a CAGR of 13.8% during the forecast period, i.e., 2022-2035. Proteomics is used to investigate: when and where proteins are expressed. rates of protein production, degradation, and steady-state abundance. how proteins are modified (for example, post-translational modifications (PTMs) such as phosphorylation) the movement of proteins between subcellular compartments.

Global Market Size, Forecast, and Trends the Over 2022 - 2035:

| Base Year | 2022 |

| Forecast Year | 2024-2035 |

| CAGR | 13.80% |

| Base Year Market Size (2022) | USD XX Million |

| Forecast Year Market Size (2035) | USD 1,44,865.5 Million |

Due to the rise in chronic diseases such as cancer, diabetes, CVDs, respiratory disorders, CKD, and others globally the use of proteomics is imperative in the current research. Study of Almost one in six deaths in 2020, or over 10 million deaths, were related to cancer, according to the WHO. Changing disease patterns are pushing the boundaries of limitations for more targeted response. As the demand for precision medicine is on the rise, research is inclining to investigate the nature of protein action and its responses at the wider scale. Proteomics offer more opportunities than genomics research.

Application Assessment Analysis:

Several categories of biomarkers are listed across disease, such as SAA1, SAA2, TFPI, MDK, DPN, MMP2 among others in lung cancer, Prostate cancer (TMPRSS2-ERG, CD 44 antigen), Parkinson (PRNP, HSPG2, MEGF8, NCAMI SPPI, LPR1, similarly for other disease. They are regards as promising protein biomarkers for the targeted proteomics assay.

Current Trends in Proteomic Applications:

Wide variety of application trends have been investigated in the report. Few of them provided below.

Technological Limitations Associated with Proteomic Analysis Explored in the Report:

Market Enablers

Market Challenges

Application (Clinical Diagnostics, Drug Discovery):

The drug discovery segment touched USD 11,453.7 million in base year (2022) and is expected to have a value of USD 66,534.7 million by 2035, rising at a substantial CAGR of 14.18% over the projected time period. This segment is also growing at the highest rate due to rising research related activities. Technological advancements are making substantial progress across various areas in the market.

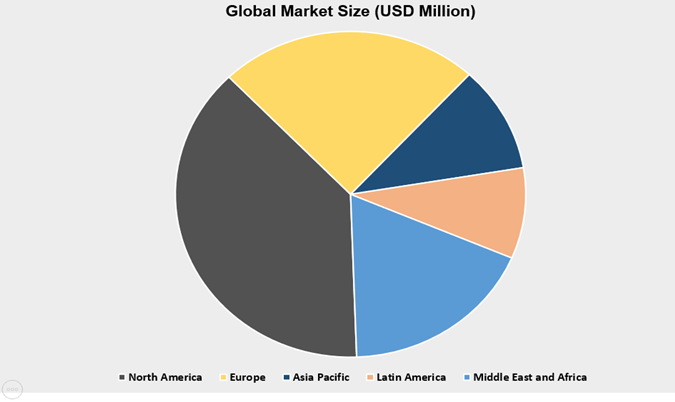

Currently, North America market is expected to offer an $ opportunities of USD XX million over the forecast period. Most lucrative market is United States, which is offering numerous market opportunities for market players. Asia Pacific is expected to grow at a growth rate of 15.64% during projected period.

Our in-depth analysis of the global Proteomics Market includes the following segments:

| Global Proteomics Market | |||

| Base Year: | 2022 | Forecast Period: | 2024-2035 |

| Historical Data: | 2022 | Market Size in 2022: | USD XX Million |

| Forecast Period 2024-35 CAGR: | 13.80% | Market Size in 2035: | USD 1,44,865.5 Million |

| Segments Covered: | By Component |

| |

| By Application |

| ||

| By End User |

| ||

| By Region |

| ||

| Key Market Drivers: |

| ||

| Key Market Restraints: |

| ||

| Key Trends: |

| ||

| Companies Covered in the Report: |

| ||