Get Free Consultation

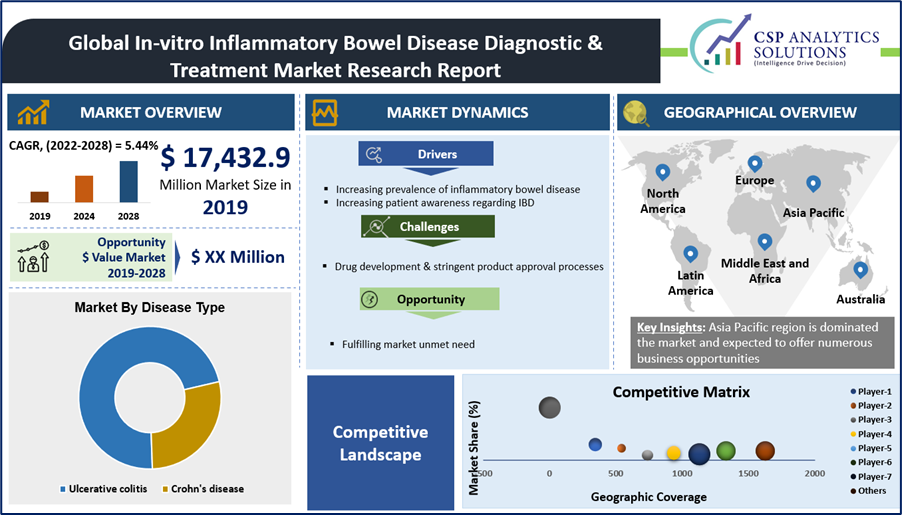

The Global In-vitro Inflammatory Bowel Disease Diagnostic & Treatment market is expected to offer an $ opportunity value of USD 7,540.33 Million.

The In-vitro Inflammatory Bowel Disease Diagnostic & Treatment market size was estimated to grow from USD 17,432.9 Million in 2019 to USD 24,973.2 Million by 2028, with a compound annual growth rate (CAGR) of approximately 5.44% between 2023 and 2028.

Global Market Size, Forecast, and Trend Over the Analysis Period, 2019 - 2028

| Base Year | 2019 |

| Forecast Year | 2022-2028 |

| CAGR | 5.44% |

| Base Year Market Size (2019) | USD 17,432.9 Million |

| Forecast Year Market Size (2028) | USD 24,973.2 Million |

Market Definition:

Inflammatory Bowel Disease refers to inflammation or chronic swelling of the intestines. General forms of IBD include Crohn’s disease (CD) and ulcerative colitis (UC). Both cause chronic inflammation in the GI tract. These conditions can cause rectal bleeding and diarrhea, bloating, abdominal cramping, pain, reduced appetite, unintended weight loss and fatigue.

Both the ulcerative colitis and Crohn’s disease markets are quite large and anticipated to experience significant growth. Multiple new mechanisms in the treatment of IBD are being developed and many are showing promising results in both ulcerative colitis and Crohn’s disease patients.

Disease Outlook:

Prevalence of Ulcerative Colitis is more than CD, Though the proportion of prevalence and incidences varies across the markets. The Approval and launches of new novel medications for the treatment of Ulcerative Colitis is the main growth driver in the expected increase in sales, whereas CD drug sales expected to increase by approximately 52.4%.

Similarities between UC and CD include immunopathology and clinical signs and symptoms (abdominal pain, diarrhea, fever, anemia, weight loss), whereas the differences between UC and CD UC are limited to colon; CD patchy through-out colon and small intestine UC more responsive to medical treatment CD requires surgery more often.

As per NCBI studies it is estimated that in 2015, an estimated 1.35% of US adults (~3.2 million) reported being diagnosed with IBD (either Crohn’s disease or ulcerative colitis). Prevalence differed by several sociodemographic characteristics, including age, race/ethnicity, education, and poverty.

According to the Crohn’s and Colitis Foundation (CCFA), approximately 70,000 new cases of inflammatory bowel disease are diagnosed in the U.S. annually. As per the CCFA report of 2019, about 1.63 million people were living with IBD in the U.S. Furthermore, as per the European Federation of Crohn’s and Ulcerative Colitis Associations (EFCCA), there were around 3.41 million people in Europe living with any form of IBD in 2020. An increasing number of people are being affected by IBD thereby increasing the demand for effective treatment options.

Currently, the highest annual incidence of IBD in Europe was 24.3 per 100,000 person-years for UC, and 12.7 per 100,000 person-years for CD, that in North America was 19.2 per 100,000 person-years for UC and 20.2 per 100,000 person-years for CD and that in Asia and Middle East was 6.3 per 100,000 person-years for UC and 5.0 per 100,000 person-years for CD. The highest prevalence for UC was 505 per 100,000 persons in Europe, and 249 per 100,000 persons in North America. The annual prevalence of CD was 322 per 100,000 persons in Europe, and 319 per 100,000 persons in North America.

Inflammatory bowel disease is an increasingly crowded market with an influx of novel therapies recently launched or nearing approvals. The mainstay of treatment of IBD is immunosuppressive

and immune-modulating agents. The ulcerative colitis and Crohn’s disease landscapes may shift soon but new drugs will compete with entrenched blockbusters, including Humira, Stelara and Entyvio, with biosimilars on the way.

The presence of robust pipeline assets for the treatment of IBD is going to significantly influence the market growth. The late-stage pipeline for ulcerative colitis includes mainly IL-23 and JAK/TYK inhibitors, microbiome drugs and cell therapies; whereas for Crohn’s disease its AbbVie’s Rinvoq (upadacitinib), as well as Lilly’s mirikizumab (LY3074828) and Takeda’s Alofisel (darvadstrocel). Pipeline insights would help in understanding the upcoming therapy assessment and market events shaping the overall market.

Among companies with active phase II and III programs and approved (not generic) ulcerative colitis and Crohn’s disease drugs, AbbVie, Inc. leads with five assets, followed by Johnson & Johnson, Pfizer, Inc. and Bausch Health Companies, Inc.

Novel Drugs Currently in Late-Phase Development:

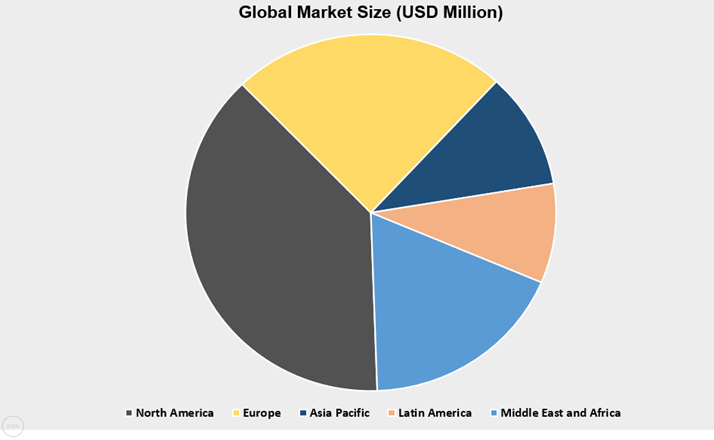

Currently North America and Europe is occupying larger share of pie and dominating the global market. As the most of the market leaders have presence in these regions and conducting clinical activities at a larger scale. Countries such as United States, India, Japan and China are offering numerous opportunities for existing and potential market leaders. As patients are aspiring for new treatment options to deal with existing IBD issues.

The Asia-Pacific Market is expected to be the most attractive market over the projected period for companies and investors. The underdiagnoses, inaccessibility in healthcare services and curing the diseases is kind of hampering the market revenue. Report has investigated the competitive structure encompasses financial health, strategies, pipeline, new product launches and collaboration among others.

In-Vitro Inflammatory Bowel Disease Market Dynamics:

Challenges:

Strategic Moves Covered in the Report:

There are varieties of treatment options addressing the wide market unmet need. Report has covered in-depth analysis around this.

Our in-depth analysis of the Global In-vitro Inflammatory Bowel Disease Diagnostic & Treatment Market includes the following segments:

| Global In-vitro Inflammatory Bowel Disease Diagnostic & Treatment Market | |||

| Base Year: | 2019 | Forecast Period: | 2024-2028 |

| Historical Data: | 2019 | Market Size in 2019: | USD 17,432.9 Million |

| Forecast Period 2022-28 CAGR: | 5.44% | Market Size in 2028: | USD 24,973.2 Million |

| Segments Covered: | By Disease Type |

| |

| By Disease Stage |

| ||

| By Test Type |

| ||

| By Treatment |

| ||

| By Patient |

| ||

| By End User |

| ||

| By Region |

| ||

| Key Market Drivers: |

| ||

| Key Market Restraints: |

| ||

| Key Trends: |

| ||

| Companies Covered in the Report: |

| ||